Van Tharp – Bear Market Strategies

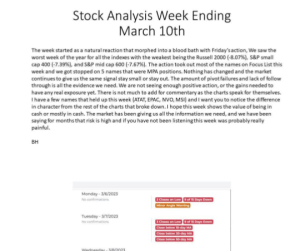

![图片[1]-Van Tharp – Bear Market Strategies-TheTrendFollowing](http://911991.xyz/wp-content/uploads/2023/12/1e6685e259212633.png)

The Objectives are to ensure you are prepared to prosper in the next bear market (or downturn).

Specifically, you will:

- Study in-depth the concept of a bear market.

- Learn what a bear market truly is and learn several ways to define and measure the bear market type.

- Know when a bear market type might be starting and how to know when it might end.

- Learn several different trading strategies suited for bear market conditions.

- Learn how options and hedging can be especially useful for bear market types.

This home study course will help you:

- Outline a big picture view of bear markets and where we may be now – from a big picture, historic viewpoint.

- Identify and define bear markets using various methodologies.

- Understand the psychology of bear markets and the personal psychology required for you to benefit from them

- Study first-hand trading experiences of bear markets from 1987;1998; 2000; 2008; Japan’s lost decade in the 90s, Oil, 2014-2015

- Understand basic options strategies useful in bear markets

- Understand some basic hedging strategies

- Understand how to be prepared to trade bear markets

- Create a Systems development process plan

- Outline your objectives for bear markets

- Create Position Sizing Strategies for bear markets

This home study helps you learn how to think about trading broad bear markets or trading a specific asset class, sector or even single symbol that is in bear mode. For a major bear market, think equities in 2008-2009. For a move limited to a sector move, think oil in 2014-2015. Imagine having had some ways you could have traded those periods effectively.

Major bear markets come only once in a while but “lesser” down moves can be found almost anytime — including during bull markets. Start using the information from this course — and be prepared for the next bear market move.

Are you prepared for the next bear market?

SIZE: 3,6 GB

Van Tharp–熊市策略

目标是确保你准备好在下一个熊市(或衰退)中繁荣发展。

具体而言,您将:

深入研究熊市的概念。

了解熊市的真正含义,并学习几种定义和衡量熊市类型的方法。

知道熊市类型何时开始,以及如何知道它何时结束。

学习几种适合熊市条件的不同交易策略。

了解期权和套期保值如何对熊市类型特别有用。

这门家庭学习课程将帮助您:

概述熊市的全貌,以及我们现在可能处于的位置——从历史的大局来看。

使用各种方法识别和定义熊市。

了解熊市的心理以及从中受益所需的个人心理

研究1987年以来熊市的第一手交易经验;1998年;2000年;2008年;日本90年代失去的十年,石油,2014-2015

了解熊市中有用的基本期权策略

了解一些基本的套期保值策略

了解如何做好交易熊市的准备

创建系统开发过程计划

概述你的熊市目标

制定熊市头寸调整策略

这项家庭研究可以帮助你学习如何思考交易广泛的熊市,或者交易处于熊市模式的特定资产类别、行业甚至单个符号。对于一个主要的熊市,想想2008-2009年的股票。对于仅限于行业变动的举措,不妨想想2014-2015年的石油。想象一下,如果你有一些方法可以有效地交易这些时期。

主要熊市只会出现一次,但“较小”的下跌几乎随时都会出现——包括在牛市期间。开始使用本课程中的信息,并为下一次熊市做好准备。

你准备好迎接下一次熊市了吗?

大小:3.6 GB

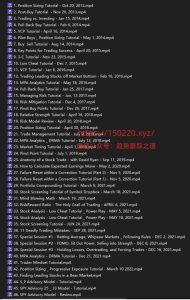

![4、[技术教程]回撤买入法视频教程 PullBack Buy Tutorial By Mark Minervini 中英字幕人工校正-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/07aee2b72d084244-300x211.png)

![[Video Course]Al Brooks - Reading Price Charts Bar by Bar The Technical Analysis of Price Action for the Serious Trader-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/96b443671b161240-300x300.jpg)