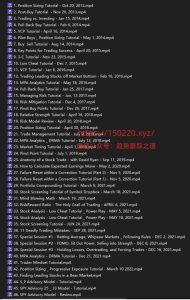

2023 Minervini Private Access月度订阅PlanA~跟着冠军实时学习交易

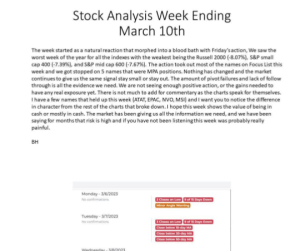

Volatility Remains the Watch Word

The S&P 500 is facing a potential 4th down week in a row with the Dow in its 5th. Earnings season has certainly contributed to the volatility. This morning we are seeing some of that volatility in MNST and RVNC. This is nothing new. Breakouts have consistently run into selling with few stock able to gain traction. As a result, our STEM model is currently on a maximum cautious RED reading.

The market spent the month of February pulling back following January’s strong rally. With the market ripping off the lows to start the year, there was the temptation to chase or use sloppy tactics. The Nasdaq rallied just over +17% while the Russell 2000 rallied nearly +14%. A 6-7% pullback is normal which came in right on schedule, but during a pullback is where you see what the market is made of.

Stocks under the surface have been too volatile overall. Again this is normal in a market that is potentially bottoming, and that’s where the discipline comes in. We have had some names that have worked, but not nearly enough on balance to offset the effects of the volatility. It’s been a good example of how a “hard penny'” environment feels. For the most part, even when trades work, the breakouts aren’t as clean and there are more shakeouts and head fakes.

One of the best indicators of the trading environment is your own performance and how much pressure or “heat” you are feeling. In a “easy dollar” market stocks will move up with relative ease; you don’t have to jockey too much as the wind is at your back and profits without much stress. Over the past year, if you didn’t diligently protected your profits, they evaporated quickly. For the most part, even trades that worked didn’t produce enough to offset the ones that didn’t.

For the time being your trading should be light and tight. But as I’ve said many times, don’t dig in with an opinion on what the environment will be. Play the hand that is dealt to you day by day, adjusting to market conditions. In a volatile market this could be frustrating, but it will keep you on the right side of the market and protect you from large losses.

-MM

本篇文章来源于微信公众号:趋势跟踪之道

![4、[技术教程]回撤买入法视频教程 PullBack Buy Tutorial By Mark Minervini 中英字幕人工校正-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/07aee2b72d084244-300x211.png)

![[Video Course]Al Brooks - Reading Price Charts Bar by Bar The Technical Analysis of Price Action for the Serious Trader-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/96b443671b161240-300x300.jpg)