![图片[1]-Wyckoff Analytics – Upgrading your Trading Plan Through Visual Back-Testing and Validation (2018)中英字幕-TheTrendFollowing](http://911991.xyz/wp-content/uploads/2023/05/22a4a82210144213.jpg)

![图片[2]-Wyckoff Analytics – Upgrading your Trading Plan Through Visual Back-Testing and Validation (2018)中英字幕-TheTrendFollowing](http://911991.xyz/wp-content/uploads/2023/05/6ea65daaa9144213.jpg)

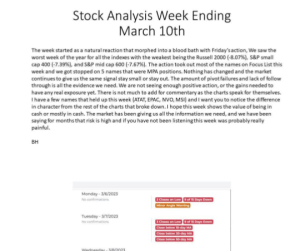

Structured back-testing shows you how well your trading plan is likely to perform under different market conditions, and whether it needs modification before you put your hard-earned capital at risk.

Roman Bogomazov has been conducting and refining back-testing of his own and others’ trading ideas for many years, and has taught these techniques as part of systems development at Golden Gate University. In 2017, Roman developed a new webinar series: Back-testing and Validating Your Trading Plan, in which he shared his insights and approach to visual back-testing.

The course provided a great opportunity for individual-level R&D of Wyckoff Method trades and was a great success with the students! In 2018, Roman offered this course again and, together with some of my advanced students, provided additional materials on developing filters and scans to expedite prospecting for some Wyckoff set-ups in your trading plan(s). In these FOUR sessions you will learn how to evaluate the profitability and expectancy of your current trading plan(s) as well as any new ideas in the future, and you will be given several examples of Wyckoff-based scans, which you can set up on stockcharts.com.

First, we discuss your current trading plans and trading routine; these sessions may include suggestions for potential improvements and adjustments to each plan presented.

Students have the opportunity to learn from others’ trading plans, as well. Next, we discuss indispensable elements of visual back-testing, including how to set up an informative process, what to emphasize during back-testing, and what data should be collected and tabulated during the analysis of results. Then, we break for three weeks to allow you ample time to conduct back-testing of your current trading plans and/or new ideas. Finally, during the last two sessions students present their back-testing results, and we discuss how these can be used to refine the underlying trading plans for increased profitability.

We also focus on developing and refining filters and scans needed to identify some of the central themes of the trading plans’ set-ups.

![[2021 Latest] Wyckoffanalytics - Scan For Success Part 3 中英字幕-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/fc071a1afb104241-300x300.jpg)

![4、[技术教程]回撤买入法视频教程 PullBack Buy Tutorial By Mark Minervini 中英字幕人工校正-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/07aee2b72d084244-300x211.png)

![[Video Course]Al Brooks - Reading Price Charts Bar by Bar The Technical Analysis of Price Action for the Serious Trader-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/96b443671b161240-300x300.jpg)