![图片[1]-Wyckoff analytics Scan For Success Part 1 中英字幕-TheTrendFollowing](http://911991.xyz/wp-content/uploads/2023/05/c119881e9d105107.jpg)

![图片[2]-Wyckoff analytics Scan For Success Part 1 中英字幕-TheTrendFollowing](http://911991.xyz/wp-content/uploads/2023/05/34b02db22a105107.jpg)

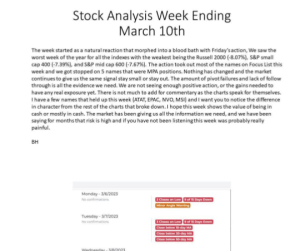

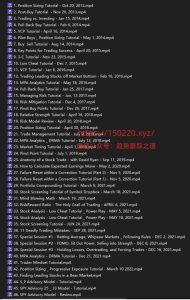

You’ve learned and practiced the fundamentals of the Wyckoff Method and are finding it to be profitable enough to use for your trading. However, like many Wyckoffians, you’ve probably found that identifying actionable

Wyckoff structural opportunities in the U.S. equity markets can be quite time-consuming. Scanning routines available on many platforms can quickly pinpoint conventional technical analysis swing trade candidates based on indicators or candlesticks. However, these scans are not necessarily optimal for the Wyckoff trader. In Scan For Success, John Colucci and Roman Bogomazov will show you how to markedly reduce the time needed to create watchlists of actionable trade candidates by using scans and filters based on Wyckoff logic.

The three two-hour sessions will include:

♦ A discussion of the meaning and roles of scanning and filtering in a trading plan

♦ The uses of scanning beyond the identification of trade candidates

♦ The basics of scanning on Stockcharts.com

♦ Scan query formation and syntax

♦ Exporting scan results to chart lists

♦ Working with scan results

♦ Analysis of chart results to determine scan efficacy

♦ Broadening scan queries for trend identification and Wyckoff structural position

♦ Structural element scanning, including accumulation, distribution, re-accumulation and re-distribution

♦ The use of the powerful “OR” structure

♦ Relative strength scanning

下载链接已放在下面, 如有问题,请私信客服。

![[2021 Latest] Wyckoffanalytics - Scan For Success Part 3 中英字幕-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/fc071a1afb104241-300x300.jpg)

![4、[技术教程]回撤买入法视频教程 PullBack Buy Tutorial By Mark Minervini 中英字幕人工校正-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/07aee2b72d084244-300x211.png)

![[Video Course]Al Brooks - Reading Price Charts Bar by Bar The Technical Analysis of Price Action for the Serious Trader-TheTrendFollowing](https://911991.xyz/wp-content/uploads/2023/05/96b443671b161240-300x300.jpg)